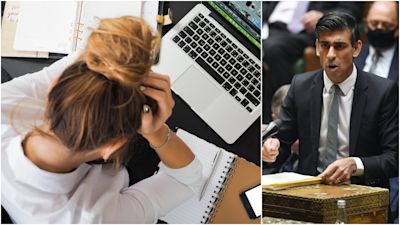

'Millions to be worse off next year': Grim outlook with high inflation and taxes

ITV News Political Correspondent Shehab Khan has the details of a gloomy economic outlook, just 24 hours after the Budget

Living standards will fall for "millions" of Britons next year, the Institute for Fiscal Studies (IFS) has warned, with Rishi Sunak's Budget failing to address "high inflation, rising taxes [and] poor growth" in the UK.

Despite the chancellor striking an "upbeat tone" in his Budget, the IFS says "voters may not get much feel good factor" out of his spending pledges, with UK finances "still undermined more by Brexit than the pandemic".

Mr Sunak did make some attempts to support workers with his spending - including a boost to Universal Credit for the lowest earners and a reduction in the price of a pint - but he admitted from next year taxes will be at their "highest level as a percentage of GDP since the early 1950s".

Director of the IFS Paul Johnson said Mr Sunak's move to raise contributions - such as in National Insurance and dividend tax - was a voluntary decision “almost entirely a set of policy choices unrelated to the pandemic”.

He said these factors will see living standards "barely rising and, for many, falling over the next year".

"Millions will be worse off in the short term," Mr Johnson added.

“Next April benefits will rise by just over 3%, but inflation could easily be at 5%," Mr Johnson said, "that will be a real, if temporary, hit of hundreds of pounds a year for many benefit recipients."

He said the chancellor was responding to government departments having been “starved of funding for a decade” under austerity, rather than to impacts of the coronavirus, despite Mr Sunak saying on Wednesday he was "corrective action" following the pandemic.

It's been predicted by a think tank that households in the UK could be paying an additional £3,000 a year by 2027 if the UK continues on the path to a "high wage high skilled" economy, a plan set out by Boris Johnson and Mr Sunak.

Watch: ITV News Economics Editor Joel Hills analyses the 2021 Budget:

But the Resolution Foundation also claims wages are likely to fall again in 2022 - they say that would be caused by rising inflation resulting in a “flat recovery for household living standards”.

The government hit back at the think tank, saying it is "misleading" to say households will be hit with an additional £3,000 in taxes, because the figure "appears to include business and employers taxes which aren't applicable directly to households".

“The same report shows that the government's policies are set to boost incomes for those at the bottom of the distribution, and that higher taxes will mostly impact middle-to-higher income households," said Downing Street.

“This government’s decisions have been worth nearly £500 per year extra to households on average, and more than £1,000 for the poorest households – and that’s before factoring in wage growth, including the rise in the National Living Wage.”

Mr Sunak insisted to ITV News that he hopes to be cutting taxes before the end of this parliament, but he was unable to guarantee that he'd be able to.

"My priority going forward is to start cutting taxes on working people," he said.

The Prime Minister's official spokesman said: "We have taken the difficult decision to raise taxes on things like the levy in a fair and progressive way and that importantly is to raise money both to help our NHS and to finally fix the long-standing problem of social care.

"That's something that the public have been calling on successive governments to do for a number of years now and it is this Government that is taking on these challenges to get them fixed for the long-term."

After “historic tax increases”, Mr Johnson said the story of Wednesday’s Budget was of “spending increases and a worrying outlook for living standards”.

Despite the "real and substantial" rises in public spending, the IFS said finances in many areas will be "substantially less" in 2024/25 than back in 2010, highlighting spending per student in further education and sixth form colleges as one area where levels will be "well below".

"This is not a set of priorities which looks consistent with long-term growth - or indeed levelling up," Mr Johnson said.

With the possibility of inflation hitting the highest level in three decades, he warned that "millions will be worse off in the short term".

Mr Johnson said welfare payments will rise by around 3%, while inflation could be 5%.

"That will be a real - if temporary - hit of hundreds of pounds a year for many benefit recipients," the director added.

"We are not at 1970s levels of inflation but we are now experiencing enough inflation that real pain will be felt as low-income households - most of whom have little in the way of financial assets - wait more than a year for their incomes to catch up.

"For some in work that may never happen."