Debenhams closes online business in Ireland as 50 major UK retailers face EU tariffs

Debenhams has been forced to close its online business in Ireland to avoid the cost of tariffs which are now required under the trade deal agreed between the UK and the EU.

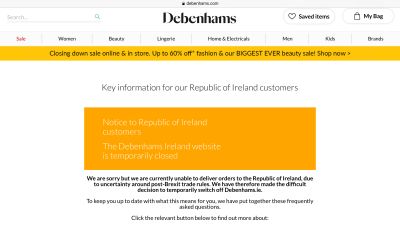

The Debenhams.ie website was taken offline on Christmas Eve as the Trade and Cooperation Agreement was published.

Customers were informed that it is no longer possible for Debenhams to deliver orders to the Republic of Ireland "due to uncertainty around post-Brexit trade rules".

Debenhams is not alone. At least 50 major UK retailers, including Marks and Spencer and Tesco, are in the process of going through their products lines, to establish how many of them will be now subject to tariffs from the EU.

River Island and H&M have both confirmed to ITV News they expect to pay penalty tariffs on some clothing sent between their UK and EU businesses.

John Lewis decided to stop delivering to EU customers, including the Republic of Ireland, last month. It also temporarily suspended deliveries to Northern Ireland after the trade deal was published.

Boots, Matalan, B&Q, Dixons Carphone and Argos (which is owned by Sainsbury’s) are also calculating their exposure.

Tariffs are taxes charged on the import of goods from foreign countries.

Under the terms of the Trade and Cooperation Agreement, trade in goods between the UK and the EU remains tariff-free.

But it has since become clear that goods which are imported into the UK and then exported on to the EU are, in many cases, not tariff-exempt because they don’t originate in the EU or the UK.

For instance, if Tesco imports a pair of pyjamas from China into the UK and then sends them to the Republic of Ireland - which is in the European Union - for sale in its 151 stores there, henceforth they could be hit by an 12% tariff.

Tariffs can be applied to food and well as clothing.

Marks and Spencer is trying to establish how much of the produce it sources from overseas and then ships from the UK to its stores in Ireland, France and the Czech Republic will be impacted.

The new tariff rules also apply to e-commerce. Any online business set up in the UK that fulfils orders from the EU is potentially affected.

Most retailers are still trying to work out what extra costs they face. Debenhams, which is in liquidation, decided it has more pressing priorities and simply stopped delivering online orders.

The British Retail Consortium said: "At least 50 of our members, all of them large retailers, face potential tariffs for re-exporting goods to the EU.

"We are working with our members and are seeking dialogue with the government and the EU on longer-term solutions to mitigate some of the effects".

On Tuesday, the Food and Drink Federation told the Financial Times that food manufacturers are being forced to cancel delivery of products to customers in Ireland for identical reasons.

The key point is that, as a result of Brexit, henceforth goods must "originate" in either the UK or the EU - under so-called "Rules of Origin" - in order to qualify for zero-tariffs.

"Clearly goods imported from Asia and re-distributed to the EU are not from the UK - they are from China or Bangladesh or wherever.

Goods will be now be subject to a tariff when entering the UK and then again when entering the EU," explains Sam Lowe from the Centre for European Reform.

The new tariff rules won’t affect shop prices in the UK but it will become more costly for UK retailers to provide goods to EU-based consumers and prices may rise accordingly.

Alternatively, retailers could decide to scale down their UK distribution network and scale up their operations in the EU. This is likely to have implications for jobs.

"I’m surprised that retailers are surprised by this," Lowe says.

"This was not a deal dependent issue, there was never going to be a solution to this. Rules of Origin were always unlikely to accommodate the re-export of goods from China".

Retailers have asked the government to try to amend the Rules of Origin covering countries that are not part of the Customs Union set out in the trade deal.

“It is appears that the UK government did not realise what they had negotiated,” one retail executive told me.

Steve Rowe, CEO at Marks & Spencer said: “Tariff free does not feel like tariff free when you read the fine print. For big businesses there will be time consuming workarounds but for a lot of others this means paying tariffs or rebasing into the EU.”

In a statement Tesco said: "We are in discussions with the HMRC and Irish Revenue about this issue and are working to find a satisfactory resolution as quickly as possible."

Debenhams has declined to comment.

In a statement, a government spokesperson said: "This is not an issue if goods remain within customs control, which means they do not enter ‘free circulation’ in the UK market.

"This can be done in a number of ways, for example through a transit procedure or keeping them under customs control.

"Even if goods have not remained under customs control, they may be able to claim returned goods relief. This means that businesses can return the goods to their original territory without paying duty. Both the EU and UK offer a relief like this.

"We continue to work closely with businesses to help them to adapt to any new trading requirements."